With attractive property prices and lowest ever loan rates, there has been a surge in the number of home loan seekers recently. Although it seems most viable for those investing in the affordable housing sector to apply for a loan, they may not always be eligible to get it approved despite their efforts. Most home buyers who are applying for a loan for the first time may not be aware of maintaining their credit profile. Here we discuss how maintaining a good credit record can prove beneficial in the long run and the factors affecting it.

What is CIBIL score?

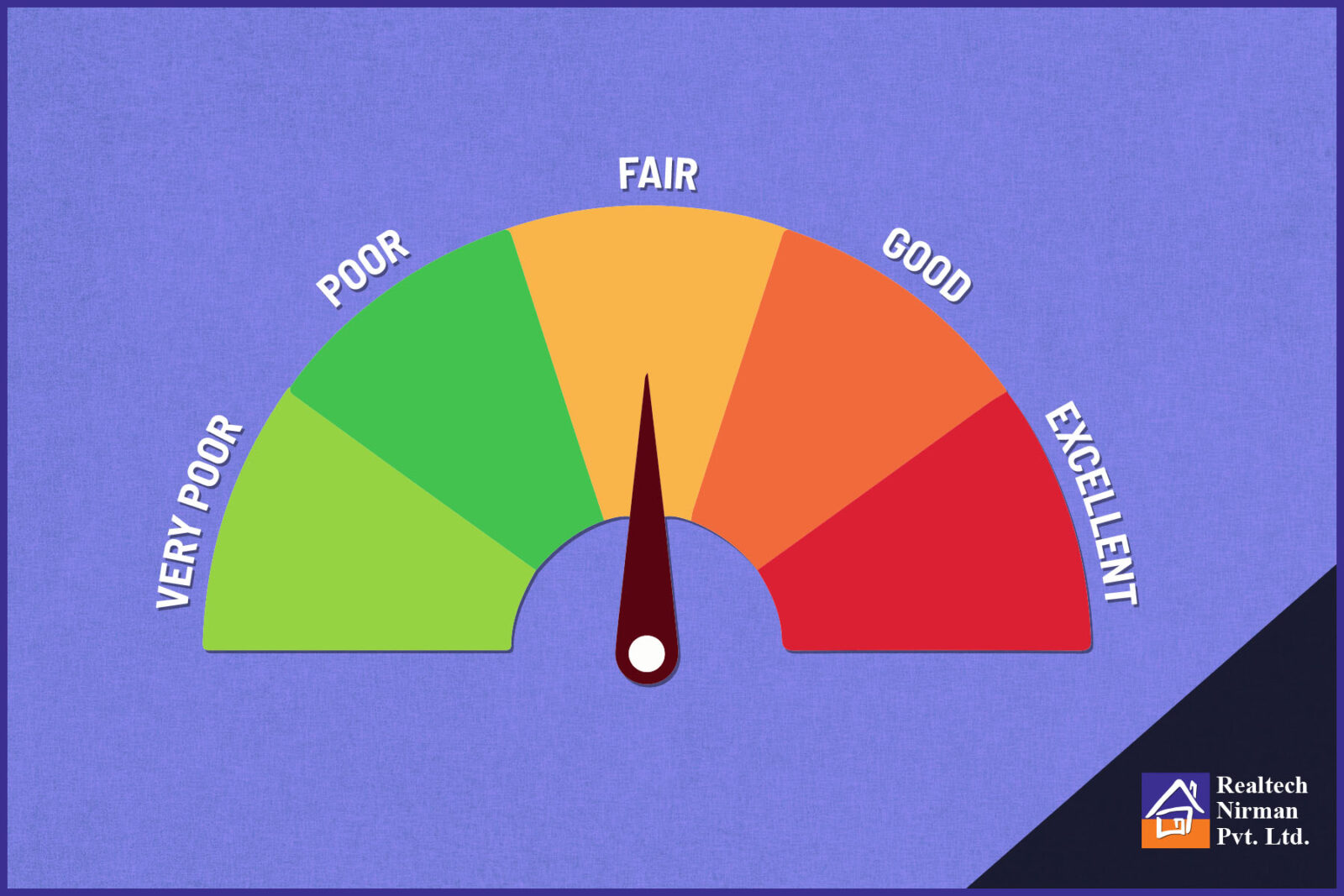

| CIBIL score is a 3-digit number between 300 and 900, that is calculated based on a borrower’s credit history is provided by TransUnion CIBIL as a part of an individual’s credit report. A score closer to 900 indicates higher creditworthiness for the borrower and lesser default risk for the lender. A Poor or no credit score makes it difficult for the borrower to get a loan approved due to the uncertainty posed in repayment to the lender. Such records make the applicant a high-risk borrower and less eligible for a loan. |

What Factors Affect the Credit Profile of a Borrower?

Good Repayment history:

The foremost important thing to be cautious about while availing credit is to pay all EMIs and card bills on time and without a single failure. While missing one or two payments in 10 years may not affect the credit score heavily, but defaulting on a loan or credit card dues may harm one’s profile for as long as seven years or more.

A Longer Credit History:

Credit score does not depend on one’s age, rather than on the history of one’s credit card or loan usage. Acquiring a satisfactory CIBIL score requires a well-managed credit archive. Older history of credit usage indicates higher chances of one being economically wise in the future.

Lower Credit Utilisation Ratio:

In simple words, it is calculated by dividing the amount one owes (one’s current outstanding debt) at present by one’s credit limit across credit card and loans expressed as a percentage. Ideally, this ratio should not exceed 30%. The lower this ratio, the more responsible is one considered as a borrower and helps to maintain a good score.

Balanced Credit Mix:

This refers to the type of credit accounts a borrower has. Home loans, cars loans and others come under secured credit whereas, personal loans and credit cards are considered unsecured credit in our country. A balanced credit mix can help maintain a high CIBIL Score by posing less risk of defaulting a loan in future.

Benefits of A High CIBIL Score

| ♠ Higher chances of loan approval |

| ♠ Lower rate of interest |

| ♠ Longer tenure |

| ♠ Higher loan amount |

| ♠ Faster loan processing |

| ♠ Reduced processing charges |

| ♠ Cash saving benefits |

While banks have switched to external benchmarking systems for floating-rate loans, borrowers can get more clarity in interest rate movements. These changes have also led to home loan seekers being extra careful of their credit profile. However, some banks adhere to internal risk assessment rather than relying on credit scores. Maintaining a good credit record can always be proof of responsible behaviour which helps to get loans without any hassles.